AI Powered Investment Strategies

Can a Computer Algorithm Correctly Identify an Investment Trend and Possibly Improve Your Long Term Investment Results?

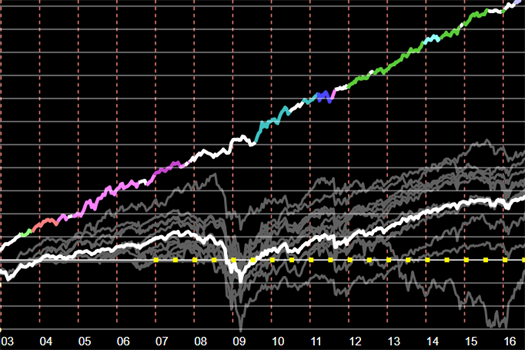

In short, we agree with academics that the answer is yes. Our monthly trading strategy i founded on decades of research and seeks to take advantage of investment Momentum which has identified that an investment's recent directional trend will continue to persist in the near future.

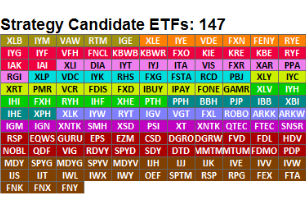

We evaluate a multitude of ETFs looking for the trend leader whether that be a sector, a region or a style such as mid-caps

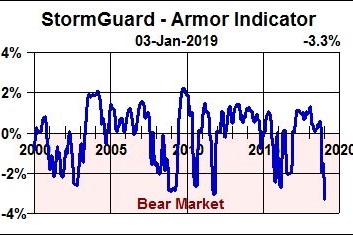

After a careful analysis, each month we invest in the ETF exhibiting the strongest trend leadership in a bull market and when a bear market strategy is invoked using the Storm Guard Armor Indicator we instead invest in the ideal bond fund to seek stability.

Our strategy also seeks to avoid large drawdowns typical of bear markets thereby preserving capital and improving results

By seeking to identify the potential start of a bear market our proprietary indicator titled Storm Guard looks at a things like sentiment, volume and moving averages in order to judge whether it is more prudent to exit stocks and instead favor a bond fund instead.

*All investing involves risk including loss of principal. No strategy assures success or protects against loss in a declining market. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.